February 1, 2018

Quick Facts:

The U.S. Department of Labor (DOL) recently issued its annual inflationadjusted penalty amounts for certain Employee Retirement Income Security Act (ERISA) violations.

The adjusted amounts are intended to create greater incentives to comply with certain federal laws applicable to health and welfare benefit plans.

Federal agencies, including the DOL, are required to make annual adjustments to the adjusted civil penalty amounts by January 15 each year.

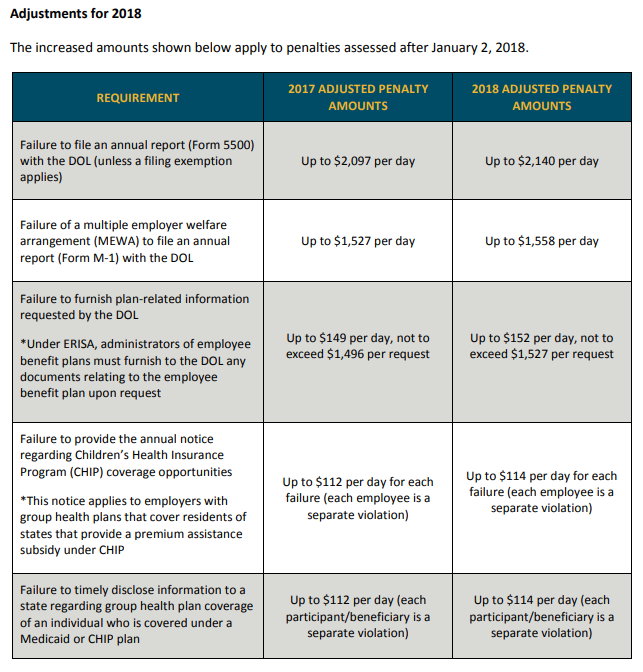

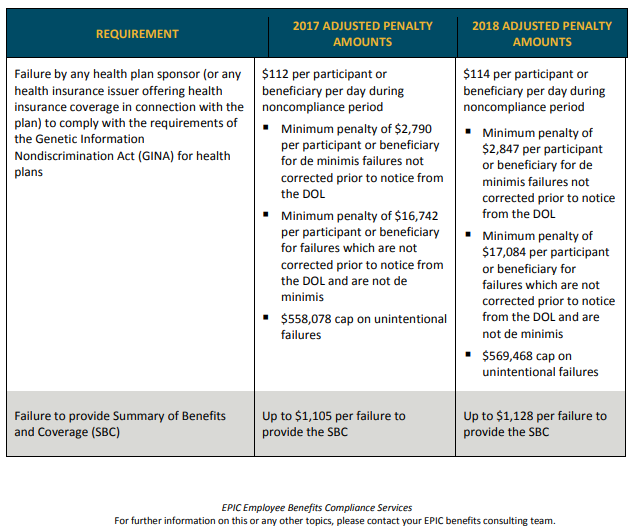

The 2018 adjustments are effective for penalties assessed after January 2, 2018 with respect to violations occurring after November 2, 2015.

Background

Legislation enacted in 2015 requires federal agencies to adjust for inflation certain penalty amounts by January 15 of each year to create greater incentives for plan sponsors to comply with their health and welfare benefit plan obligations. The law specifically requires the DOL to adjust penalties applicable to health and welfare benefit plans that the agency regulates under ERISA. In 2017, the DOL provided adjusted penalty amounts for violations assessed after January 2, 2017 with respect to violations occurring after November 2, 2015. This past month, the DOL issued adjusted amounts – as shown in the table on the following pages – for penalties assessed after January 2, 2018, with respect to violations occurring after November 2, 2015.

Action steps

Employers should review their health plans to ensure compliance with ERISA’s requirements in order to avoid penalties. For example, employers should make sure they are complying with ERISA’s reporting and disclosure rules, including Form 5500, annual CHIP notice and SBC requirements.